marinedictionary.ru

Learn

Where Can I See Stocks

Our professional live stocks chart gives you in depth look at thousands of stocks from various countries. There are a number of sources for stock prices, some that will be easier to find locally than others. There are also titles that are good for obsolete. See the quotes that matter to you, anywhere on marinedictionary.ru Start browsing Stocks, Funds, ETFs and more asset classes. Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity. Stock charts can vary in their construction from bar charts to candlestick charts to line charts to point and figure charts. Get free real-time stock prices for the TSX today or use our premium investor tools to research your next investment on TSX, TSXV, or Alpha. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures. Our professional live stocks chart gives you in depth look at thousands of stocks from various countries. There are a number of sources for stock prices, some that will be easier to find locally than others. There are also titles that are good for obsolete. See the quotes that matter to you, anywhere on marinedictionary.ru Start browsing Stocks, Funds, ETFs and more asset classes. Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity. Stock charts can vary in their construction from bar charts to candlestick charts to line charts to point and figure charts. Get free real-time stock prices for the TSX today or use our premium investor tools to research your next investment on TSX, TSXV, or Alpha. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures.

Use the Stocks app on Apple Watch to see info on the stocks you follow on your iPhone. See the iPhone User Guide for more information. With Google Nest or Home speaker or display, you can get information on your individual stocks and portfolio, as well as stay on top of the global market. A stock market site by Business Insider with real-time data, custom charts and breaking news. Get the latest on stocks, commodities, currencies, funds. Trade stocks with E*TRADE from Morgan Stanley. Easy-to-use tools, free research, and personalized guidance mean you never have to face the markets on your own. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. All - Get the latest stock market news, stock information and charts, data analysis reports, as well as a general overview of the market landscape from. We offer $0 online trades and access to powerful stock research and tools. Plus 24/7 support for your financial needs. See stocks by countries, by industries, or by type. This information is only available through the Bloomberg Professional service. In-depth market analysis, real-time stock market data, research and earnings from marinedictionary.ru Scotia iTRADE clients can choose from a wide range of stocks. Invest in stocks listed on major North American exchanges or pick from stocks sold over-the-. Get data on global stock markets and stock prices. You can choose to view the information by continent, specific country or specific stock index. Check out the best stock market forecasts and trading ideas: USA. Live stock quotes, latest news, earnings calendar, and much more. Whether you're looking for stocks making new highs or searching for complex setups that combine multiple technical indicators, our advanced market scanning. marinedictionary.ru offers free real time quotes, portfolio, streaming charts, financial news, live stock market data and more. Check out the best stock market forecasts and trading ideas: USA. Live stock quotes, latest news, earnings calendar, and much more. After-hours stock trading coverage from CNN. Get the latest updates on post-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Find Stock quotes, charts, reports, news and more for all your favorite stocks. Invest with TD according to your financial plan and outlook. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Free real-time stock quotes, news, charts, time&sales, options and more for Nasdaq, NYSE and the OTC exchanges. Keep all your stocks in a Watchlist or store. To get a stock quote, you need to add a linked record for a company or fund. Then you can use another column to extract the price.

Upi Bank Account

A list of bank names live on UPI, whose customers can use UPI to transfer, pay or collect money directly from one bank account to another bank account. Any Axis Bank or non-Axis Bank account can be added in the app, basis the mobile number used to register for UPI i.e. mobile number used to register on. Open Google Pay. · At the top right, tap your photo. · Under "Payment methods," tap Bank account. · Select the bank account for which you want to create a new UPI. "Unified Payment Interface" (UPI) enables a bank account holder to send and receive money in their account using smartphones to any UPI ID without. Rent, cell phone top-ups, and utility bills can all be paid quickly online. Banks that help UPI The following banks support UPI services: State Bank of India . UPI for Current Account works just as well as it does for a Savings Account user. The Current Account holders just need to ensure that the bank where they have. You can create up to 4 UPI IDs on Google Pay for each bank account you add. · You can't use VPA or UPI IDs created through other UPI apps or net-banking portals. in India, UPI is a real-time payment system that allows instant, free money transfers between bank accounts via mobile devices. A unique UPI ID or Virtual. Union Bank of India presents you Bhim UPI app download, With UPI code /account number login into Bhim UPI login. UPI banking made easy to send money online. A list of bank names live on UPI, whose customers can use UPI to transfer, pay or collect money directly from one bank account to another bank account. Any Axis Bank or non-Axis Bank account can be added in the app, basis the mobile number used to register for UPI i.e. mobile number used to register on. Open Google Pay. · At the top right, tap your photo. · Under "Payment methods," tap Bank account. · Select the bank account for which you want to create a new UPI. "Unified Payment Interface" (UPI) enables a bank account holder to send and receive money in their account using smartphones to any UPI ID without. Rent, cell phone top-ups, and utility bills can all be paid quickly online. Banks that help UPI The following banks support UPI services: State Bank of India . UPI for Current Account works just as well as it does for a Savings Account user. The Current Account holders just need to ensure that the bank where they have. You can create up to 4 UPI IDs on Google Pay for each bank account you add. · You can't use VPA or UPI IDs created through other UPI apps or net-banking portals. in India, UPI is a real-time payment system that allows instant, free money transfers between bank accounts via mobile devices. A unique UPI ID or Virtual. Union Bank of India presents you Bhim UPI app download, With UPI code /account number login into Bhim UPI login. UPI banking made easy to send money online.

You can also request money through the app from a UPI ID. Send Money; Request Money; Scan & Pay; Transaction; Profile; Bank Account. Send money by. You can also request money through the app from a UPI ID. Send Money; Request Money; Scan & Pay; Transaction; Profile; Bank Account. Send money by. Unified Payment Interface [UPI] is a payment system developed by National Payment Corporation of India [NPCI]. It is a platform where customer can fetch and. The essence of UPI lies in its seamless integration which allows multiple bank accounts into a single mobile application. By combining several banking features. It is used on mobile devices to instantly transfer funds between two bank accounts. The mobile number of the device is required to be registered with the bank. Bank account. UPI Solution offers multiple features such as simplified on-boarding, availability of different transaction types, multiple ways to execute. UPI stands for unified payments interface. It's used to transfer money between bank accounts via one single application. From your marinedictionary.ru app, go to Amazon Pay dashboard and tap Amazon Pay UPI. Choose the SIM card / mobile number associated with your bank account if you have. Most banks will have UPI enabled on their eponymous apps; however, you can download third-party, non-banking digital payment apps as well. For online merchants. Unified Payment Interface - YES BANKs UPI payment service allows hassle-free instant funds transfer. Download our Mobile Banking app to use the UPI service. Step 1: Log in to the iMobile Pay app · Step 2: Click on 'UPI Payments' · Step 3: Verify Mobile Number · Step 4: Click on Manage > My profile · Step 5: Create UPI. On the Bank's App, the User will have an option to set a virtual payment address and initiate transaction via UPI. User can link other bank accounts through a. What is BHIM? BHIM (Bharat Interface for Money) is a UPI enabled initiative to facilitate safe, easy & instant digital payments through your mobile phone. Standard Chartered UPI is a single mobile application used to send & collect money from your multiple bank accounts. Use the quick and seamless way to. A UPI ID is a UPI user's virtual payment address (VPA), which aids banks in keeping track of a user's account. Its basic function is to identify your customers. The BHIM Axis Pay UPI (Unified Payment Interface) App is an easy to use app with which you can link any bank account to your UPI Id and send or receive. One of the first steps to start using UPI is to create a UPI ID, which serves as a unique identifier linked to your bank account. In this beginner's guide, we. When a user has accounts in multiple Banks, he/she has to download the mobile banking application of all those banks. Whereas in UPI, any Bank Customer may. Simplify UPI payments with Pocket UPI by MobiKwik. No bank account linking is required. Add funds and pay any QR code or UPI ID hassle-free! Unified payment Interface (UPI) · Provides the "Collect Money" option · Single Android app for funds transfer using account of any · Bank participating in UPI.

Bmo Harris Current Cd Rates

BMO Bank CD Rates ; % · $1k, - ; % · $1k, - ; % · $1k, - ; % · $1k, -. Money market account rates from BMO Harris do vary by account balance, but Compare CD rates to see how they stack up against MMA's today. Money. Headquartered in Chicago, BMO (formerly known as BMO Harris) offers certificates of deposit (CDs) with a range of term options with rates up to %. As rates fall, your CD may still have a higher interest rate than the current market CD rates. Glossary. CD: A CD or certificate of deposit is a type of savings. The rates offered on BMO Bank Standard CDs are quite paltry, earning anywhere from % to % APY, far below the national average. Investors can earn a. BMO Harris Platinum money market account offers an APY starting at % and ranging up to % (APY stands for annual percentage yield, rates may change). If the CD is renewed at maturity to a new CD with less than $1,, it will be paid a rate of % with a % APY. If this is a standard CD: At the maturity date, this Account will automatically renew to another CD of equal term at the then current interest rate and APY for. Month CD ; 18 Month, %, % ; 24 Month, %, % ; 30 Month, %, % ; 36 Month, %, % ; 48 Month, %, %. BMO Bank CD Rates ; % · $1k, - ; % · $1k, - ; % · $1k, - ; % · $1k, -. Money market account rates from BMO Harris do vary by account balance, but Compare CD rates to see how they stack up against MMA's today. Money. Headquartered in Chicago, BMO (formerly known as BMO Harris) offers certificates of deposit (CDs) with a range of term options with rates up to %. As rates fall, your CD may still have a higher interest rate than the current market CD rates. Glossary. CD: A CD or certificate of deposit is a type of savings. The rates offered on BMO Bank Standard CDs are quite paltry, earning anywhere from % to % APY, far below the national average. Investors can earn a. BMO Harris Platinum money market account offers an APY starting at % and ranging up to % (APY stands for annual percentage yield, rates may change). If the CD is renewed at maturity to a new CD with less than $1,, it will be paid a rate of % with a % APY. If this is a standard CD: At the maturity date, this Account will automatically renew to another CD of equal term at the then current interest rate and APY for. Month CD ; 18 Month, %, % ; 24 Month, %, % ; 30 Month, %, % ; 36 Month, %, % ; 48 Month, %, %.

Earn up to % Annual Percentage Yield (APY) · Let's find interest rates for the Relationship Plus Money Market account based on your location. · Save smarter. BMO Bank rates and products ; Checking accounts, Up to % APY ; Savings account, % APY ; MMAs, Up to % APY ; CDs, Up to % APY. Open a Standard CD Today! ; 12 months, %, % ; 18 months, %, % ; 24 months, %, % ; 30 months, %, %. Headquartered in Chicago, BMO (formerly known as BMO Harris) offers certificates of deposit (CDs) with a range of term options with rates up to %. Grow your savings with our high-yield online-only CD s. No minimum balance. $0 minimum opening deposit. 6 available fixed terms (6 months to 60 months). Grow your savings with our high-yield online-only CD s. No minimum balance. $0 minimum opening deposit. 6 available fixed terms (6 months to 60 months). CD Rates change daily and current rate is available upon request. The City Name of Institution: BMO Harris Bank N.A.. Location of Principal Place of. When compared to the % APY offered for a month CD at BMO, it's clear that you can lock in a great rate on your savings through this bank. But you can. Deposit Rates - September 7, ; 12 Mo CD. %, $1, ; 13 Month CD Special. %, $1, ; 18 Mo CD. %, $1, ; 24 Mo CD. %, $1, BMO Harris Bank and BMO Harris Central would be resolved under the Federal Deposit CDs issued by BMO Harris. Bank, securities lent or sold under. Watch your savings grow with an account that offers competitive rates and terms that best fit your goals and lifestyle. Open an IRA Certificates of Deposit (CDs) with BMO bank for as little as $ and you'll be on your way to safe, secure savings. Find more about it now. According to the FDIC, the average month CD rate today is %. However, many banks currently offer rates of 4%–5% or more, especially for terms under two. CIT Bank vs BMO Bank ; Term CDs up to % APY. $1, minimum opening deposit. · eChecking: % APY with $25,+ balance and % APY on balances under. Earn up to % Annual Percentage Yield (APY) · Let's find interest rates for the Relationship Plus Money Market account based on your location. · Save smarter. Horrible customer service at the BMO Harris Bank branch at University Parkway and Honore Avenue in Sarasota, Florida. (BMO Harris' brick-and-mortar CDs have an 11 business day policy on this, according to BMO Harris.) BMO Alto doesn't offer a no-penalty CD. The early. % APY. $5 reward every month you save $ or more, for the first year. Chase Savings: % APY. $5 monthly service fee waived with either a $ Terms range from six months to five years, and current CD rates range from % to % APY. BMO Bank, formerly BMO Harris, is one of the largest. Top 10 Best Cd Rates Near Glenview, Illinois ; 1. BMO Harris Bank. · mi ; 2. Huntington Bank. · mi ; 3. Northbrook Bank & Trust. · mi ; 4.

How Much Do You Need To Open A Bank

You would have to apply for and obtain a state or federal bank charter, get FDIC approval, and obtain any other permits required in your area. How can you prove your identity online? · Photo ID, such as: driving licence, passport or EU ID card · A selfie to compare with your photo ID · We might also need. Starting a bank in the United States costs between $, to $1 million. You will need a group of experienced bankers that pass an FBI background check and. do so much more with digital banking. See what you can do. Credit cards You must open the account online and enter the promo code to be eligible to. Fortune Recommends: Vio Bank currently offers the highest APY for an MMA: %. You only need $ to open an account, and there's no monthly fee to worry. If you want to get a new bank account, there are some things you need to find out: the main types of bank accounts, and what they are used for. how to open. The minimum is around $12 million, but that means capital on hand when you actually open the bank, so in addition you need enough to cover. Everyone's banking needs are a little different, so think about your lifestyle and what you need your checking account to handle. Need to pay bills online? Do. Your account number or debit card number to make your opening deposit into your new Bank of America account; Co-applicant's personal information (if applicable). You would have to apply for and obtain a state or federal bank charter, get FDIC approval, and obtain any other permits required in your area. How can you prove your identity online? · Photo ID, such as: driving licence, passport or EU ID card · A selfie to compare with your photo ID · We might also need. Starting a bank in the United States costs between $, to $1 million. You will need a group of experienced bankers that pass an FBI background check and. do so much more with digital banking. See what you can do. Credit cards You must open the account online and enter the promo code to be eligible to. Fortune Recommends: Vio Bank currently offers the highest APY for an MMA: %. You only need $ to open an account, and there's no monthly fee to worry. If you want to get a new bank account, there are some things you need to find out: the main types of bank accounts, and what they are used for. how to open. The minimum is around $12 million, but that means capital on hand when you actually open the bank, so in addition you need enough to cover. Everyone's banking needs are a little different, so think about your lifestyle and what you need your checking account to handle. Need to pay bills online? Do. Your account number or debit card number to make your opening deposit into your new Bank of America account; Co-applicant's personal information (if applicable).

How do I open a checking account? How do I open a checking account? You can open a checking account online or in-person at a Wells Fargo branch. You must be. When you need to bank-on-the-go, all types of checking accounts can be accessed How Much Should You Keep in Checking vs. Savings? It's important to. People do everything online these days. But when it comes to banking, you may have questions. Learn how to open a bank account online today. Many banks charge by the month for you to keep your money in an account with them. Monthly fees can range from $4 to $25, but they are generally easy to avoid. The interest they pay for savings accounts. You usually need to make an initial deposit between $25 and $ to open a savings or checking account. Tip. Find. What do I need to open a checking account online?Expand. Must be 18 or older Customers between 13 and 16 years old must open the Clear Access Banking account. How to open an overseas account · 1. Choose your destination. Tell us where you are now, and where you want to open an account. · 2. Check you can apply. You can. How Much Money Do You Need To Open a Checking Account? The amount of money necessary to open a checking account varies by financial institution and your. Our online bank accounts for individuals · Our online bank accounts for businesses · What do I need to apply for a bank account online? · It's easy to switch to. What type of account should I get if I'm looking for interest? How Much Money Do You Need to Open a Bank Account? The simple answer: it can vary from bank to bank. It can also depend on the bank account type. At. In addition to documents that verify your identity, age, or address, you may also need to provide a minimum initial deposit when opening a bank account. A. Here are the eligibility requirements, required documents and actions you need to take to open your bank account. Do I need a social security number (SSN) to. do so much more with digital banking. See what you can do. Credit cards You must open the account online and enter the promo code to be eligible to. Visit a financial center. Learn more about what you need to open a business bank account. How long does it take for my business checking account to be opened. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. You should review any planned financial. Here are the eligibility requirements, required documents and actions you need to take to open your bank account. Do I need a social security number (SSN) to. More help managing money. More help managing money, open. Short-Term Savings Calculator. See how long it takes to save for the things you want and need. Try. To qualify for a LifeGreen Savings Account, you must have a Regions checking account. The minimum opening deposit amount for a Regions checking account is $ We make digital banking simple and safe · Transfer money on the go with Zelle · Bank from anywhere with mobile check deposit · Manage all your accounts securely.

Swipecoin App

#swipecoin · How This SWIPECOIN APP Makes Me Money Everyday & 10 Trading Facts You MUST know · Learn how to place #Crypto trades - #Swipecoin Scalper Scanner by. SwipeCoin is a Mobile and Web App that provides digital currency trade ideas and education. SwipeCoin app provides the best RISK / REWARD setups. welcome to swipecoin. live education and recordings. swing market ideas swipe coin 3 step system. market ideas. chat guidance. goLIVE sessions. meet. Swipe is a cryptocurrency and Visa Debit card platform. It has a DeFi app that allows users to convert cryptos, fiat, and stablecoins and issue their own. Report a Bug! About · Blog · Terms | Privacy | Site Map | Site Map Calendar · Myfxbook IOS. Myfxbook Android. Myfxbook App Gallery. Myfxbook Chrome Extenstion. In brief. You have Swipecoin applications on your phone, there is a notification for buying or selling prices, e.g. Bitcoin, Ethereum and many other. SwipeCoin is an exciting educational, trade idea and analysis platform centered around different crypto currency pairs. The master is doing analysis and. Trading bitcoin or running an exchange business, SwipeCoin is a perfect brand name for your online presence Related Keywords. App Development Banking &. Swipecoin APK download for Android. SwipeCoin is an educational platform around different crypto currency. #swipecoin · How This SWIPECOIN APP Makes Me Money Everyday & 10 Trading Facts You MUST know · Learn how to place #Crypto trades - #Swipecoin Scalper Scanner by. SwipeCoin is a Mobile and Web App that provides digital currency trade ideas and education. SwipeCoin app provides the best RISK / REWARD setups. welcome to swipecoin. live education and recordings. swing market ideas swipe coin 3 step system. market ideas. chat guidance. goLIVE sessions. meet. Swipe is a cryptocurrency and Visa Debit card platform. It has a DeFi app that allows users to convert cryptos, fiat, and stablecoins and issue their own. Report a Bug! About · Blog · Terms | Privacy | Site Map | Site Map Calendar · Myfxbook IOS. Myfxbook Android. Myfxbook App Gallery. Myfxbook Chrome Extenstion. In brief. You have Swipecoin applications on your phone, there is a notification for buying or selling prices, e.g. Bitcoin, Ethereum and many other. SwipeCoin is an exciting educational, trade idea and analysis platform centered around different crypto currency pairs. The master is doing analysis and. Trading bitcoin or running an exchange business, SwipeCoin is a perfect brand name for your online presence Related Keywords. App Development Banking &. Swipecoin APK download for Android. SwipeCoin is an educational platform around different crypto currency.

Swipe powers a robust platform that enable businesses to create card programs for users to spend anything globally. Swipe connects and is partnered with major. App Cryptocurrency Portfolio Tracker Social Trading Network Automated Trading Bot And Many More Does marinedictionary.ru come with Trademark or Business. Swipe ecosystem allows easy conversion of cryptocurrencies, stablecoins, and fiat currencies to one and another. The platform hosts a large number of coins and. Download APK Swipecoin for Android: SwipeCoin is an exciting educational, trade idea and analysis platform centered around different crypto currency pairs. Swipecoin - SwipeCoin is an exciting educational, trade idea and analysis platform centered around different crypto currency pairs. Swipecoin. likes. SWIPECOIN is the most complete ecosystem which largely emphasises on bringing value to invested funds. The platform is offering. I acknowledge having received, read & understood the foregoing EULA. Swipecoin Apps PRIVACY POLICY POLICIES & PROCEDURES TERMS AND CONDITIONS REFUND POLICY. where the world charts, chats and trades markets. we're a supercharged super-charting platform and social network for traders and investors. free to sign up. Download: Swipecoin APK (App) - ✓ Latest Version: - Updated: - marinedictionary.ruoin - MEYA EDITOR - Free - Mobile App for Android. Experience the power of the ultimate tool to transform your trading business. With its sleek design and advanced features, Swipecoin Live empowers you to. SwipeCoin is an educational platform around different crypto currency. Download Swipecoin Latest Version APK for Android from APKPure. SwipeCoin is an educational platform around different crypto currency. Swipecoin Description: SwipeCoin is an exciting educational, trade idea and analysis platform centered around different crypto currency pairs. New SwipeCoin Trade Alert Check SwipeCoin App For Details. views November 16, DCX ACADEMY. Forwarded from Stock and Crypto (ES). We're. Download and play Swipecoin android on PC will allow you have more excited mobile experience on a Windows computer. Let's download Swipecoin and enjoy the. Dive deep into the market with our state-of-the-art tools: Harmonic Scanner, Impulse, Levels, SwipeCoin, Aurous, Cypher, Blaze, and Wolfrush. Each tool. New SwipeCoin Trade Alert Check SwipeCoin App For Details. K views January 3, DCX ACADEMY. New SwipeCoin Trade Alert Check. Saan?? Dito sa SM Malls Online app! Find exclusive discounts, promos, and deals when download and register on the SM Malls Online app! Swipe coin is game changer!! A digital app that gives digital currency trade ideals that will lead you to the bag! While getting the trade ideals you are also.

Contribute To Both Roth And Traditional Ira

If your MAGI is equal to or less than the lower phase-out threshold, you can deduct your full IRA contribution even if you're an active participant in a company. The key differences between a Roth and Traditional IRA are eligibility requirements and tax implications. · Anyone with earned income may contribute to a. You can contribute to a traditional or Roth IRA even if you participate in another retirement plan through your employer or business. However, you may not be. In , the total contributions an investor can make to both traditional and Roth IRAs is $7, To be eligible to contribute to a Roth IRA, your. A retired taxpayer between 59 ½ and 70 ½ years of age may choose whether or not to receive distributions. For federal income tax purposes, contributions to. It's possible to have both Roth and traditional IRAs in your investment portfolio. You can contribute to both as long as your total contributions don't exceed. You may contribute simultaneously to a traditional IRA and a Roth IRA (subject to eligibility) as long as the total contributed to all (traditional or Roth). You can have both, but in one year, you can't exceed the combined limit to put in the account. You can put in one account and in the. It may be appropriate to contribute to both a traditional and a Roth IRA—if you can. Doing so will give you taxable and tax-free withdrawal options in. If your MAGI is equal to or less than the lower phase-out threshold, you can deduct your full IRA contribution even if you're an active participant in a company. The key differences between a Roth and Traditional IRA are eligibility requirements and tax implications. · Anyone with earned income may contribute to a. You can contribute to a traditional or Roth IRA even if you participate in another retirement plan through your employer or business. However, you may not be. In , the total contributions an investor can make to both traditional and Roth IRAs is $7, To be eligible to contribute to a Roth IRA, your. A retired taxpayer between 59 ½ and 70 ½ years of age may choose whether or not to receive distributions. For federal income tax purposes, contributions to. It's possible to have both Roth and traditional IRAs in your investment portfolio. You can contribute to both as long as your total contributions don't exceed. You may contribute simultaneously to a traditional IRA and a Roth IRA (subject to eligibility) as long as the total contributed to all (traditional or Roth). You can have both, but in one year, you can't exceed the combined limit to put in the account. You can put in one account and in the. It may be appropriate to contribute to both a traditional and a Roth IRA—if you can. Doing so will give you taxable and tax-free withdrawal options in.

Contributing to a Roth IRA involves using after-tax dollars to make contributions. Therefore, you've already paid tax on the money you're putting into your Roth. Traditional IRAs and Roth IRAs have the same contribution limits, which is set each year. Both traditional and Roth IRAs: For , your total contribution. Yes, you can maintain both types of IRAs at the same time. You can even make contributions to both types of IRAs in the same year. But your contributions to. The government allows workers with traditional IRAs to move money to a Roth IRA so long as they pay income tax on the converted amount. Key Takeaways: Roth IRAs. You can have both but the total contribution to both combines for 7k. Split that 7k any way you want between them. Larger contribution amount · Automatically comes out of pay check · Built-in dollar cost averaging (purchase of a fixed dollar amount at regular intervals). The annual contribution limit can be split between your IRAs. And if you currently have a traditional IRA and decide a Roth IRA would be a better fit, you could. Unlike a Roth IRA, contributions to a Roth (k) are not subject to earnings limits. This means if you aren't eligible to contribute to a Roth IRA because your. You might consider “hedging” your tax risk by investing through both types of accounts. Keep in mind that the IRS' annual contribution limit is the total you. You can, however, contribute $3, to your Traditional IRA and another $3, into your Roth IRA for a total of $6, Or you could contribute $1, into. Unsure whether a traditional or Roth IRA is best for you? You can invest in both while you make up your mind. Here are some ways that you can do so. Yes, you can contribute to both a Roth IRA and traditional IRA. For some, this is a great way to diversify earnings. Just keep in mind the contribution. However, it may be possible to split contributions between the two accounts – providing the flexibility and control for you to decide what's best each year. 2). Roth IRAs provide no tax break for contributions, but earnings and qualified withdrawals are generally tax-free. So with traditional IRAs, you avoid taxes up to. At a 25% tax rate, in order to contribute $75 they must earn $ $25 will be paid in taxes and the remaining $75 contributed to the Roth IRA. At retirement. IRA contribution rules · If you're under age 50, you can contribute up to $ · If you're age 50 or older, you can contribute up to $8, You can roll a traditional account into a Roth account, but you'll have to pay taxes on a portion of the amount you move. Multiple IRAs and RMDs. Each IRA. Both are available to anyone over the age of 18, allow a maximum contribution of $6, annually ($7, if over age 50)¹, and allow you to withdraw money at. Diversifying your retirement savings strategy by contributing to both Roth and Traditional IRAs can offer unparalleled flexibility and enhanced control over. The total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than $6, ($7, if you're age 50 or.

How Much Does Bankruptcy Hurt Your Credit

This is because you were good at managing money before, so bankruptcy will hurt your credit more. Can I Get Credit During and After Bankruptcy? When you're in. Bankruptcy usually lasts a year, at which point you will be removed from the register, assuming you have acted in a fit and proper way, i.e. have complied with. A bankruptcy will always be considered a very negative event by your FICO Score. How much of an impact it will have on your score will depend on your entire. Filing for bankruptcy can severely impact credit scores, with higher initial scores resulting in more significant declines, potentially up to points. · A. The law states that credit reporting agencies may not report a bankruptcy case on a person's credit report after ten (10) years from the date the bankruptcy. It is true that declaring bankruptcy can cause a drastic change in your credit score and comes with other long-term credit implications. However, it's always. A bankruptcy filing will certainly impact your credit rating in the short term. But bankruptcy will actually improve or “heal” credit ratings over the long. The key is, if you have debt you do not believe you can recover from, filing for bankruptcy may hurt your credit initially, but it will allow you to begin the. What does bankruptcy do to your credit score? Although the exact impact can vary, a bankruptcy will generally hurt credit scores. Credit scores help tell. This is because you were good at managing money before, so bankruptcy will hurt your credit more. Can I Get Credit During and After Bankruptcy? When you're in. Bankruptcy usually lasts a year, at which point you will be removed from the register, assuming you have acted in a fit and proper way, i.e. have complied with. A bankruptcy will always be considered a very negative event by your FICO Score. How much of an impact it will have on your score will depend on your entire. Filing for bankruptcy can severely impact credit scores, with higher initial scores resulting in more significant declines, potentially up to points. · A. The law states that credit reporting agencies may not report a bankruptcy case on a person's credit report after ten (10) years from the date the bankruptcy. It is true that declaring bankruptcy can cause a drastic change in your credit score and comes with other long-term credit implications. However, it's always. A bankruptcy filing will certainly impact your credit rating in the short term. But bankruptcy will actually improve or “heal” credit ratings over the long. The key is, if you have debt you do not believe you can recover from, filing for bankruptcy may hurt your credit initially, but it will allow you to begin the. What does bankruptcy do to your credit score? Although the exact impact can vary, a bankruptcy will generally hurt credit scores. Credit scores help tell.

How much bankruptcy will hurt your credit score depends on how low your score already is. If you have a score of , considered “good” to “excellent” by. After a bankruptcy has been filed, the sooner you begin retaining or re-establishing credit in good standing, the sooner you can expect your FICO score to. Until a creditor is satisfied they can continue to report missed payments for many years. Negative items will remain on a credit report for 7 to 10 years from. How long does bankruptcy stay on your credit file? Bankruptcy shows on your credit file for six years or longer if it is extended. Find out more about. It generally takes months before your credit improves after bankruptcy. FindLaw reviews what you need to know, how to improve your credit score. Filing for bankruptcy is sometimes the right decision, but it is not without consequences. Those include: Your credit will be shot. Anyone considering. This will result in a potentially negative impact on your credit score. Even though your Chapter 13 Bankruptcy discharge may be fully complete. Average Credit. So your credit score and the impact bankruptcy has to your credit score really depends on various factors. There is a common incorrect belief. These low-scoring bankruptcy filers will generally see a significant improvement in their credit scores shortly after discharge—approximately 75 points for. Chapter 13 bankruptcy, generally a payment plan to pay down debt agreed to with the court, stays on your credit score for seven years – again from the date of. A Chapter 7 bankruptcy is typically removed from your credit report 10 years after the date you filed, and this is done automatically. A higher score means that you can borrow more and at a lower interest rate. Filing bankruptcy can cause your credit score to drop dramatically. If a lender is. That's because the higher your pre-bankruptcy scores, the bigger the drop in your scores after you file bankruptcy. On the other hand, if you already have low. A Chapter 13 bankruptcy will stay on your credit report for seven years after you file for bankruptcy. While this might seem like a long time, it's less than if. Fact or Fiction: Filing for bankruptcy is the only thing that will ruin your credit. · Fact or Fiction: Personal bankruptcy destroys your credit score forever. If you come to the point where bankruptcy is your best option to obtain financial recovery, rest assured that the damage to your credit will be temporary. In. Research has shown that a bankruptcy usually hurts your FICO credit score for about two years. If you think you can go by the next two years without making a. Many people worry that filing bankruptcy will severely impact their credit, and they are right in the sense that Chapter 7 bankruptcy can negatively affect your. How Does Bankruptcy Affect Your Credit Rating? Bankruptcy is likely to drop your credit score to the lowest possible rating at most Canadian credit bureaus. Chapter 13 bankruptcy, generally a payment plan to pay down debt agreed to with the court, stays on your credit score for seven years – again from the date of.

How Much Can You Deduct From Charitable Donations

Your deduction limit will be 60% of your AGI for cash gifts. Note that if you're planning a large donation that's close to or exceeds your AGI limit, you may. A: The amount of an individual's deduction may be limited to 50%, 30%, or 20% of his or her adjusted gross income depending on the type of organization the. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. You can access the application by clicking the “Apply for a Charitable Contribution Credit” link under the Apply Online section. For calendar year , the. Your deduction limit will be 60% of your AGI for cash gifts. Note that if you're planning a large donation that's close to or exceeds your AGI limit, you may. CO resident taxpayers who do not itemize their federal income tax deductions may deduct qualified charitable gifts in excess of $ annually for state income. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. A taxpayer who both makes qualifying charitable contributions and claims the standard deduction on their federal income tax return for the same tax year can. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. Your deduction limit will be 60% of your AGI for cash gifts. Note that if you're planning a large donation that's close to or exceeds your AGI limit, you may. A: The amount of an individual's deduction may be limited to 50%, 30%, or 20% of his or her adjusted gross income depending on the type of organization the. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. You can access the application by clicking the “Apply for a Charitable Contribution Credit” link under the Apply Online section. For calendar year , the. Your deduction limit will be 60% of your AGI for cash gifts. Note that if you're planning a large donation that's close to or exceeds your AGI limit, you may. CO resident taxpayers who do not itemize their federal income tax deductions may deduct qualified charitable gifts in excess of $ annually for state income. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. A taxpayer who both makes qualifying charitable contributions and claims the standard deduction on their federal income tax return for the same tax year can. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given.

Part B income does not include dividends, capital gains, or interest (other than interest from MA banks). The charitable deduction is limited to 50% of the. State and local taxes. Federal law limits your state and local tax (SALT) deduction to $10, if single or married filing jointly, and $5, if married filing. How much in donations can I claim on tax? There is no real limit to how much you can claim on tax in general. However, gifts and donations cannot create tax. you discuss your gift with your financial, legal or tax advisor. Individuals can claim up to 75% of their net income in charitable donations each year. In. Donations can be carried forward for up to five years. Generally, a corporation can claim a deduction for charitable donations up to 75% of the corporation's. In 20there was a special provision on your Federal return where you could deduct up to $ ($ for MFJ in ) in charitable. This provides a tax benefit only if you are able to itemize your deductions. The IRS outlines in Publication that cash payments to an organization or. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written. What is a charitable contribution deduction? A charitable contribution gives you the option of deducting your charitable donations to qualified charitable. For tax years beginning in , an individual who does not itemize deductions may claim an above-the-line deduction in computing adjusted gross income (AGI) of. Noncash Charitable Contributions — applies to deduction claims totaling more than $ for all contributed items. If a donor is claiming over $5, in. An overall limitation of 50 percent of an individual's contribution base applies to total charitable contribution deductions claimed by the individual (or. If you donate property to certain charitable organizations, your deduction might be limited to 50% of your AGI. There's a 30%-of-AGI limit for capital gain. Then in they take the $29, standard deduction. With this option, the couple has $5, of additional tax deductions over the two years. In addition, if. For example, if you have $25, in taxable income this year and donate 60% of that, or $15,, to charity, you will receive the deduction for the whole gift. Taxpayers must keep records to substantiate cash and noncash charitable contributions. Those who are deducting noncash charitable contributions with a total. If you donate securities instead of cash, you may deduct up to 30% of your AGI. Pretty simple so far, right? Now, what if you want to donate a combination of. If you surpass the charitable deduction limit for one year, you can carry-over that deduction for a maximum of five years. These increased limits, raised. If your total deduction for gifts of property is more than. $, you must complete and enclose federal Form ,. Noncash Charitable Contributions. If your.

Dividend Dates Explained

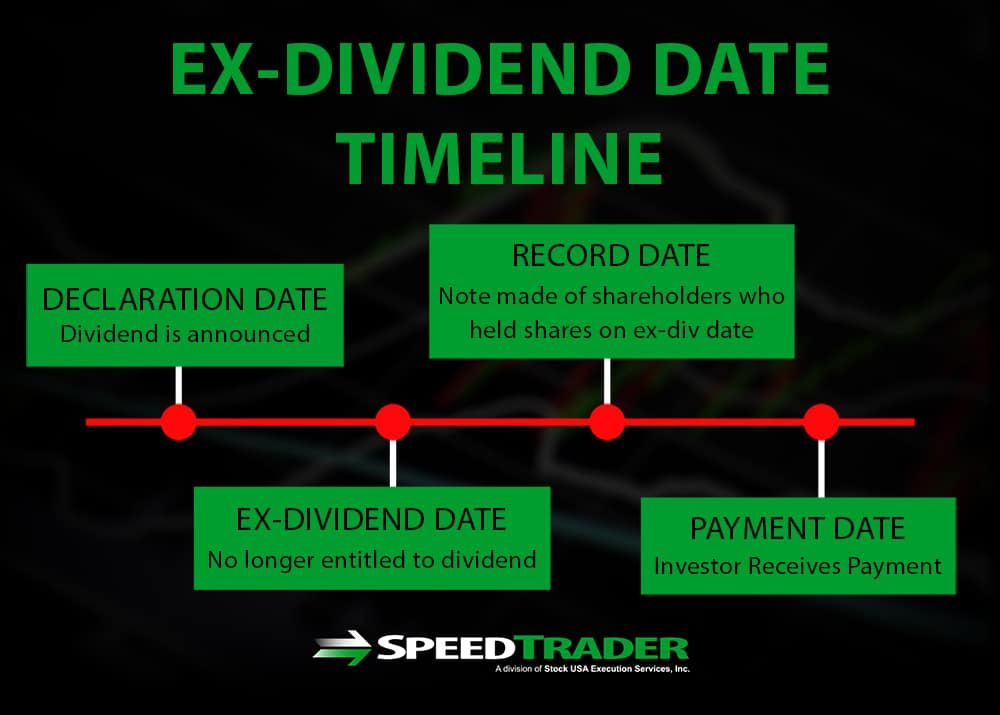

Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time. Dividend Record Dates for Common Shares are generally Feb. 15, May 15, Aug. 15 and Nov. 15 in each year, unless the 15th falls on a Saturday or Sunday. When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend. Companies also use. Important dividend dates · Announcement date – as the name suggests, this is the date any dividend payments are announced by the company. · Ex-dividend date – in. 7, meaning anyone who bought the stock on Aug. 7th or later would not get a dividend. Conversely, shareholders who purchased their shares on Tuesday, Aug. 6th . Dividend distribution is associated with four primary dates – announcement date, ex-dividend date, record date, and payment date. The announcement date, as the. 1. Declaration Date. The declaration date is the date on which the board of directors announces and approves the payment of a dividend. · 2. Ex-Dividend Date. The ex-dividend date is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial. The date by which you must be on the company's books as a shareholder to receive the dividend. The date the dividend is paid to shareholders. Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time. Dividend Record Dates for Common Shares are generally Feb. 15, May 15, Aug. 15 and Nov. 15 in each year, unless the 15th falls on a Saturday or Sunday. When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend. Companies also use. Important dividend dates · Announcement date – as the name suggests, this is the date any dividend payments are announced by the company. · Ex-dividend date – in. 7, meaning anyone who bought the stock on Aug. 7th or later would not get a dividend. Conversely, shareholders who purchased their shares on Tuesday, Aug. 6th . Dividend distribution is associated with four primary dates – announcement date, ex-dividend date, record date, and payment date. The announcement date, as the. 1. Declaration Date. The declaration date is the date on which the board of directors announces and approves the payment of a dividend. · 2. Ex-Dividend Date. The ex-dividend date is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial. The date by which you must be on the company's books as a shareholder to receive the dividend. The date the dividend is paid to shareholders.

The ex-dividend date is an investment term that determines which stockholders are eligible to receive declared dividends. The ex-dividend date of a stock is the day on which trading in the shares starts without the eventual dividend value. You must consider two critical dates in. It is the day when the stock of the company goes ex-dividend, meaning the stock from that day does not carry the value associated with its next dividend payment. Shares trading ex-dividend refers to shares that no longer carry the right to the next dividend payment. The ex-dividend date is the first date that a share. These dates will tell an investor when they will receive the dividends and whether or not they are eligible to receive the latest dividend. If you buy a fund right before the record date, part of your investment will be returned to you when distributions are paid. This is known as “buying a dividend. Important dividend dates · Announcement date – as the name suggests, this is the date any dividend payments are announced by the company. · Ex-dividend date – in. A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the. IBM's dividends are normally paid on the 10th of March, June, September and December. The dividend record date normally precedes the dividend payment date by. When a company pays a special dividend to its shareholders, the stock price is immediately reduced. The ex-dividend date. This downward adjustment in the stock. The ex-dividend date is the date by which you need to own the dividend-paying stock in order to receive the upcoming dividend payment. Remember, the ex-dividend date is typically the same day as the record date. If investors want to receive a stock's dividend, they have to buy shares of stock. There are practically four dates associated with the payment of dividend to a company's shareholders, either interim or final. One of these dates is the. dividend or the issuance of rights or warrants. (b) Normal Ex-Dividend, Ex-Warrants Dates. (1) In respect to cash dividends or distributions, or stock dividends. When a company announces a dividend, it's agreeing to pay a certain amount per share of stock at a certain point in time. Hence the meaning of the phrase “. To determine whether you should get a dividend, you need to look at two important dates. They are the "record date" or "date of record" and the "ex-dividend. It is important to note that ownership of the share on the ex-dividend date is the key to the dividend payout. Everyone who owns the share on this date will. Price-to-Dividend Ratio: This is the ratio of the company's current stock price to its annual dividend payout. It's useful for comparing the dividend. Meaning, an investor buying the stock on the ex-date does not receive the The acronym 'DERP' can help you remember the order of the dividend dates. If a common stock dividend is paid to holders of preferred stock when there is an accumulated deficit, the dividend should be accounted for at fair value with a.

How Do I Find Out About My Stimulus Payment

The IRS created a Get My Payment portal so you can learn the status of your payment. To report missing checks or ask other questions, call the IRS at. Visit marinedictionary.ru for more information on Economic Impact Payments. EIP Card. Curious about how you can use your EIP Card, transfer funds, get cash or obtain. Create an account on marinedictionary.ru You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only. I'm not sure if I already received a stimulus payment. How do I check? If you don't make enough income to have to file taxes, you may miss out on the federal STIMULUS check, also known as the Economic Impact Payment. Get My Payment (GMP) on the marinedictionary.ru website · marinedictionary.ru for general questions on Economic Impact Payments. The IRS's Get My Payment application is the only official way to find out when you're scheduled to receive your stimulus payment. In fact, the IRS has asked. If you haven't shared your direct deposit information with the IRS before, or you need to update your mailing address, you can use the IRS Get My Payment tool. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS. The IRS created a Get My Payment portal so you can learn the status of your payment. To report missing checks or ask other questions, call the IRS at. Visit marinedictionary.ru for more information on Economic Impact Payments. EIP Card. Curious about how you can use your EIP Card, transfer funds, get cash or obtain. Create an account on marinedictionary.ru You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only. I'm not sure if I already received a stimulus payment. How do I check? If you don't make enough income to have to file taxes, you may miss out on the federal STIMULUS check, also known as the Economic Impact Payment. Get My Payment (GMP) on the marinedictionary.ru website · marinedictionary.ru for general questions on Economic Impact Payments. The IRS's Get My Payment application is the only official way to find out when you're scheduled to receive your stimulus payment. In fact, the IRS has asked. If you haven't shared your direct deposit information with the IRS before, or you need to update your mailing address, you can use the IRS Get My Payment tool. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS.

Those with questions can call the stimulus check hotline at IRS Get My Payment Tool. Get your payment status. See your payment type. Provide. Check Payment Status · Stimulus Payment Not Received. If your status shows your third stimulus payment was issued but you still haven't received it, you can. The IRS will use your most recently filed taxes to determine where to send your stimulus money and the amount you are eligible to receive. The Economic Impact (Stimulus) Payment were approved and distributed by the U.S. Treasury. Alabama cannot legally offset social security benefits; however, the. Collect your stimulus check by filing your taxes through GetYourRefund! · Check the status of your stimulus check on the IRS Get My Payment website. Eligible individuals should use the Get My Payment tool to find out when and how the EIP3 was sent. Please note the payment status for the first and second. Check your email account for an email from the IRS. Click on the “Confirm my acount's email address” link. Follow the instructions. Go back to your account. If you do not know which agency authorized the payment, call the Bureau of the Fiscal Service Call Center at They can help you determine which. All first stimulus checks were issued by December 31, If you are missing your stimulus check or didn't get the full amount that you are eligible for, you. If you didn't receive your Economic Impact (stimulus) Payments (EIP), you can get them by claiming the Recovery Rebate Credit on your tax returns. The fi. What if my stimulus money was issued, but was lost, stolen or destroyed? You can start a payment trace by calling the IRS at Or mail or fax a. Get My Payment. Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over and Here are some answers for those who haven't received their second or third stimulus payment. Check the Get My Payment Tool. Taxpayers who have registered their direct deposit information with the IRS should receive their stimulus payment by January 4. How will the IRS know where to. To get to economic impact payment, or EIP, information from the main number requires pressing 7 after listening to the initial messages. The EIP hotline can be. To start a payment trace: Call the IRS at ; Mail or fax a completed Form to the IRS. To complete the Form How do I get the stimulus payment? · The stimulus payments were processed by the IRS. · Most people already received their payments, which were based on income. You can view your stimulus payments by logging in or creating an IRS account. If you are due to receive an EIP, the payments show up on the “Account Transcript. Your 2nd stimulus payment (approved January ) and 3rd stimulus payment (approved March ) cannot be garnished to pay child support. The IRS will send payments by direct deposit, paper check, and prepaid debit cards. They will likely deliver your third stimulus the same way you received the.